Tulum’s Real Estate Rental Market in 2023 [Revenue & Occupancy]

Welcome to your ultimate guide to calculating rental revenue in Tulum, brought to you by RivieraMayaCozy.com!

If you’ve ever dreamed of dipping your toes into the lucrative Tulum real estate market, you’re in the right place. This guide isn’t just a bunch of numbers and facts; think of it as your friendly neighborhood expert, here to walk you through the ins and outs of rental investments in Tulum.

Whether you’re a seasoned investor or just starting to explore the idea, our easy-to-understand breakdown, based on real Airbnb listings, will help you calculate your potential Return on Investment (ROI) without breaking a sweat.

So, pull up a chair, grab a refreshing drink (we’re thinking something tropical!), and let’s dive into the world of Tulum rentals.

Revenue from Property Rentals in Tulum: Introduction

Buckle up, because we’re about to take a detailed tour through the various property sizes available for rent in Tulum, ranging from quaint 1-bedroom spaces to grand 6-bedroom residences.

Our guide is crafted in a way to provide you with a comprehensive understanding of the average rental revenue for each property type, covering both the bustling high season and the more tranquil low season.

We understand that the devil is in the details, and that’s exactly where we shine. For each property size – 1, 2, 3, 4, 5, and 6 bedrooms – we’ll not only talk about the potential earnings but also delve into the occupancy rates. Knowing how often these properties are filled during both seasons is key to painting a complete picture of your investment potential.

This step-by-step approach will help you easily navigate through the information, allowing you to find the sweet spot that aligns with your investment goals and preferences.

So, whether you’re eyeing a cozy retreat for honeymooners or a spacious villa for family vacations, we’ve got all the info you’ll need to make a smart, informed decision.

Please note: the graphs show prices in Mexican Pesos. Find USD equivalents in brackets.

Average Rental Revenue & Occupancy for 1-Bedroom Apartments

Embarking on the investment voyage through Tulum’s rental seas, 1-bedroom properties serve as the ideal sailboats to kickstart your adventure.

These properties are not just about creating personal sanctuaries; they’re about smart investment strategies, blending comfort and affordability with revenue. Usually, getting a 1-bedroom apartment equals buying a condo in Tulum.

In the sun-soaked high season of January, these 1-bedroom havens are a hot ticket, boasting a robust occupancy rate of 59.4%.

This translates into a substantial average revenue of $31.3K MXN (approx. $1,819 USD), indicating a thriving market with a demand that keeps these smaller abodes bustling.

On the flip side, the low season brings a more subdued climate of bookings.

In September, the occupancy drops to a more reflective 34%, mirrored by a gentler revenue stream of $10.8K MXN (approx. $628 USD).

Investing in a 1-bedroom property in Tulum is akin to curating an experience for guests that pays dividends. With careful planning and targeted marketing during the varying seasons, investors can optimize occupancy rates and maximize returns.

Average Rental Revenue & Occupancy for 2-Bedroom Properties

Stepping up the ladder, 2-bedroom properties in Tulum open the door to a more diverse clientele, promising a blend of comfort and community. Perfect for small families or groups, these units offer a bit more elbow room and the potential for higher earnings.

As we delve into the numbers, the vibrancy of Tulum’s high season shines through. With a commendable occupancy rate of 57.8% in January, these apartments are more than just a place to stay; they’re a hot commodity.

This demand translates into an attractive average revenue of $51.7K MXN (approx. $3,005 USD), highlighting the busy streets and full bookings that characterize Tulum’s peak tourist times.

Transitioning to the low season, the occupancy understandably wanes to 31.2% in September.

Although quieter, these apartments still maintain a steady pace, pulling in an average revenue of $18.9K MXN (approx. $1,098 USD).

This quieter period can be a strategic time for property maintenance and upgrades, ensuring that the apartments remain top choices for the next high-season rush.

Each property type tells its own story, and for 2-bedroom apartments, it’s a narrative of family fun, shared experiences, and the warmth of group travel. As an investor, tapping into the potential of these units means marketing them as the go-to for those looking for a shared yet spacious getaway.

Average Rental Revenue & Occupancy for 3-Bedroom Properties

As we venture further into the heart of Tulum’s rental landscape, 3-bedroom properties emerge as the bastions of group getaways and family retreats. These spacious properties cater to those seeking the communal spirit of vacationing with friends or family without forgoing the luxury of personal space.

The data paints a picture of prosperity during the high season, with January’s occupancy rate at a healthy 57.7%.

It’s a time when these larger properties become bustling hubs, earning an impressive $105.8K MXN (approx. $5,813 USD) on average. This peak season performance underscores the popularity of 3-bedroom properties among larger travel parties, eager to soak up the sun and culture of Tulum together.

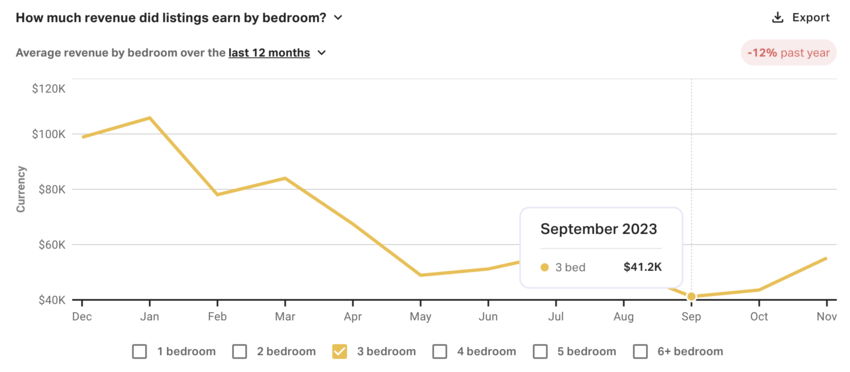

As the tides of tourism recede in the low season, the occupancy for these properties dips to 34.7% in September, mirroring a natural slowdown across the board.

Yet, they still command a respectable average revenue of $41.2K MXN (approx. $2,383 USD), showcasing their enduring appeal even outside the high-season buzz.

Savvy investors would do well to market these properties as ideal spots for those looking to create lasting vacation memories. With strategic positioning and thoughtful amenities, these properties can be positioned as year-round retreats, balancing seasonal fluctuations with consistent appeal.

Average Rental Revenue & Occupancy for 4-Bedroom Properties

Diving into the world of 4-bedroom properties in Tulum, we’re talking about the crème de la crème of vacation rentals.

These aren’t just any homes; they’re sprawling sanctuaries that promise luxury, privacy, and ample space for large families or groups. Whether it’s a Tulum penthouse with panoramic views, a full-sized house, or a luxury villa, these properties stand as the epitome of vacation grandeur.

In the high season, the allure of these expansive dwellings is evident, with a solid occupancy rate of 56.7% in January.

This is when Tulum’s vibrant energy is at its peak, and larger groups flock to enjoy the festivities, leading to a handsome average revenue of $219.7K MXN (approx. $12,770 USD) for these properties.

It’s a time when the investment in larger spaces pays off, providing guests with an unforgettable escape that’s worth every penny.

The narrative shifts slightly in the low season, with the occupancy rate seeing a dip to 30.2% in September.

Yet, even during these quieter months, 4-bedroom properties maintain a significant draw, with revenues around $86K MXN (approx. $5,000 USD). This resilience in the market is a testament to the enduring appeal of luxury and space that these properties offer.

4-bedroom properties are not just a place to sleep; they’re a destination in themselves, offering privacy, luxury, and an unparalleled group experience.

For investors, marketing these properties should be about showcasing their ability to be a private oasis in the heart of paradise, a place where memories are made and treasured.

Average Rental Revenue & Occupancy for Large Size 5-Bedroom Properties

When it comes to 5-bedroom properties in Tulum, we’re not just scaling up in size; we’re elevating the entire vacation experience. These extensive estates are where luxury meets the lap of nature, offering unparalleled space and amenities for those looking to indulge in a truly grand holiday.

In the realm of high season, these properties are akin to private resorts, boasting an occupancy of 66.5% in October, a spike that suggests a late-season bloom in bookings.

This period brings in a lavish average revenue of $321.4K MXN (approx. $18,680 USD), a figure that reflects the high value placed on expansive living quarters and the privacy they offer to larger groups or multiple families vacationing together.

On the other end of the spectrum, the low season tells a different tale but not one of stark contrasts.

With a September occupancy of 43.7%, there’s a noticeable drop yet it remains robust compared to smaller property types, pulling in a respectable $118.6K MXN (approx. $6,900 USD).

This suggests that the allure of 5-bedroom properties transcends the high-season hype, maintaining a steady draw throughout the year.

When talking about these grand properties, the narrative shifts to emphasize the opulence and exclusivity they offer. It’s about more than just a stay; it’s about offering a full-fledged luxury experience that can’t be confined to a single season.

For the savvy investor, these properties are a testament to Tulum’s versatility as a destination, appealing to high-end vacationers looking for a lavish retreat at any time of the year.

Average Rental Revenue & Occupancy for 6-Bedroom Properties

The 6-bedroom properties stand out as both spacious retreats for visitors and lucrative assets for their owners.

In the peak of the high season, when the sun kisses the Mayan ruins and the sea sparkles invitingly, these properties unsurprisingly deliver a hefty income.

Our chart tops at a snug $389.8K MXN (approx. $22,671) in January 2023, reflecting the allure of Tulum’s peak tourist time. Occupancy? A healthy 64.6% in December 2022, a testament to the destination’s winter draw.

But as you have already above, every paradise has its quieter moments. Come September 2023, when the rush ebbs, the occupancy dips to a more subdued 36.4%, mirrored by a softer revenue of $188.7K MXN (approx. $10,969 USD).

It’s a time when the buzz fades, and the pace slows, but the beauty of Tulum remains, unchanging.

Whether it’s the vibrant high or the tranquil low season, Tulum’s 6-bedroom properties seem to ride the waves of tourism with grace. It’s a cycle of sun-drenched revelry and peaceful respite, each with its own charm and opportunities.

Conclusion

In conclusion, the rental market in Tulum presents a unique and lucrative investment opportunity, with a range of property sizes catering to diverse needs and preferences.

From cozy 1-bedroom apartments ideal for couples to grand 6-bedroom estates perfect for large groups, each property type offers its unique advantages in terms of rental revenue and occupancy rates.

During the bustling high season, properties of all sizes enjoy high occupancy and revenue, driven by Tulum’s vibrant tourist appeal.

The smaller properties, such as 1 and 2-bedroom apartments, provide intimate, affordable options for travelers, while larger properties like 4, 5, and 6-bedroom homes offer luxury and exclusivity, attracting larger groups and families. This period represents the peak of investment return, showcasing Tulum’s capacity to draw a wide array of visitors.

The low season, while quieter, still presents opportunities. It’s a time for strategic planning, maintenance, and upgrades, ensuring that properties remain attractive and competitive. Even during these slower months, larger properties maintain a steady appeal, indicating the enduring allure of luxury and space.

This comprehensive analysis underscores the importance of understanding both the high and low seasonal trends in Tulum’s rental market. Investors can optimize their returns by aligning their property offerings with market demands and smartly navigating the seasonal dynamics.

About The Author

Oswaldo Ortega

Hi there! I'm Oswaldo Ortega González, a 34-year-old real estate agent based in the stunning Riviera Maya. Originally hailing from Mexico City, I've immersed myself in the beauty of this coastal paradise for the past 5 years. With an equal 5-year span in the real estate sector, my journey here has been nothing short of remarkable. Before diving into the world of properties, I worked in retail onboard cruise ships, which was quite the adventure. But my real estate calling was ignited by a deep desire to help people discover the immense potential in real estate investments. I've always believed in the power of real estate to pave the way to financial freedom, and I'm excited to guide others on this path. When I'm not busy exploring the world of properties, you can often find me engrossed in a good book or working up a sweat through exercise. And when it comes to satisfying my taste buds, nothing beats the tantalizing flavors of Tacos de pastor. The driving force behind everything I do is the simple yet powerful desire to create unique and unforgettable experiences with my family and loved ones. It's what motivates me each day as I help my clients make their real estate dreams a reality in the breathtaking Riviera Maya.